Singapore’s Transport Revolution: The Road Ahead

Singapore’s Long-Term Plan Review (“LTPR”) is a forward-looking strategic framework designed to guide the nation’s infrastructural development over the next 50 years. Led by the Urban Redevelopment Authority, the LTPR assesses long-term land use, transportation networks, and economic priorities to ensure sustainable growth in a land-constrained environment.

This article explores two key pillars of the LTPR, namely, rail network expansion and aviation development, while examining the potential challenges these projects may face.

Long-Term Plan Review

The LTPR represents a significant change from Singapore’s past urban planning approaches, reflecting shifts in priorities and technological possibilities. Unlike previous iterations of the Concept Plan – which were typically reviewed every 10 years with a focus on medium-term infrastructure and housing needs – the LTPR adopts a more ambitious, flexible, and adaptive framework designed to address the long-term needs.

Singapore Construction Prospect 2025 – Civil Engineering Construction Demand

The Building & Construction Authority (“BCA”) forecast a growth in construction demand from S$7.7 billion (year 2024) to between S$9.0 billion to S$10.0 billion (year 2025), with sizeable projects from, amongst others, the Thomson-East Coast Line Extension, and Cross Island Line (Phase 1), and new MRT stations at Sungei Kadut connecting the Downtown Line (“DTL”) and the North-South Line (“NSL”).

Expansion of Rail Network (MRT & LRT)

As part of the LTPR, Singapore aims to expand its rail network to 360km by the 2030s, up from approximately 250km today. Key projects include:

- Circle Line 6

- Downtown Line 2 & 4 Extensions

- Johor Bahru – SG Rapid Transit System

- Jurong Region Line

- North East Line Extension

- Thomson-East Coast Line

- Cross Island Line.

Cross Island Line – Phase 1 and 2

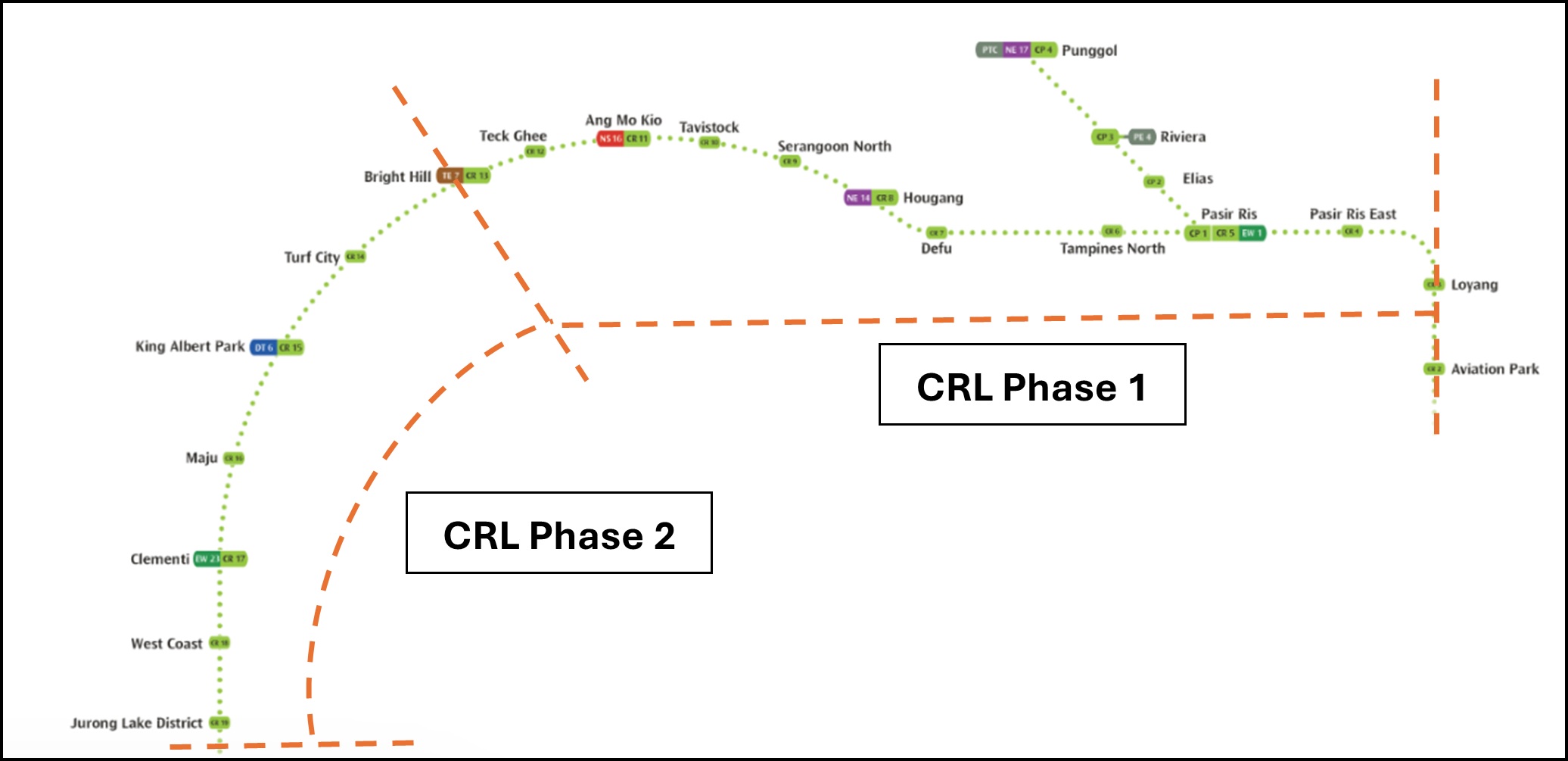

Out of the above projects, the Cross Island Line (“CRL”) is one of Singapore’s most ambitious MRT projects, designed to transform the city-state’s public transport network by providing a high-capacity, cross-country rail link. Spanning approximately 50 kilometres, the CRL will be entirely underground, making it Singapore’s longest fully subterranean MRT line. When operational, it will have 8 interchange stations.

Courtesy of LTA

Once completed, the CRL will be Singapore’s first fully underground autonomous metro line, with driverless trains running at 2.5-minute intervals during peak hours, reducing cross-island travel time up to 40 minutes.The CRL is being developed in two main phases, with Phase 1 expected to open by 2030 and Phase 2 by 2032. CRL Phase 1 is approximately 29 kilometres long and will have 12 stations, running from Aviation Park to Bright Hill. CRL Phase is approximately 20 kilometres long with 6 stations running from Turf City to Jurong Lake District.

The upcoming CRL, highlighted in yellow, with Singapore’s existing MTR lines is shown below.

Singapore MRT System with the Future Cross Island Line

Current Progress

Phase 1 (Aviation Park to Bright Hill) – Planned opening 2030

- Tunnelling (90% Complete) All 12 station tunnels for Phase 1 are structurally complete TBMs finished boring under ecologically sensitive areas (Central Catchment Nature Reserve) Final tunnel segments being connected between Hougang and Defu stations

- Station Construction Aviation Park Station: Superstructure nearly complete (roofing installed) Pasir Ris Interchange: Linking works with existing East West Line ongoing Hougang Station: Excavation for interchange with Downtown Line complete

Phase 2 (Bright Hill to Jurong Lake District) – Planned opening 2032

- Early Works Underway Utility diversion works ongoing near Turf City and Clementi Geological surveys completed for Jurong West stretch Tender awarded for Turf City station construction (May 2024)

Aviation Expansion

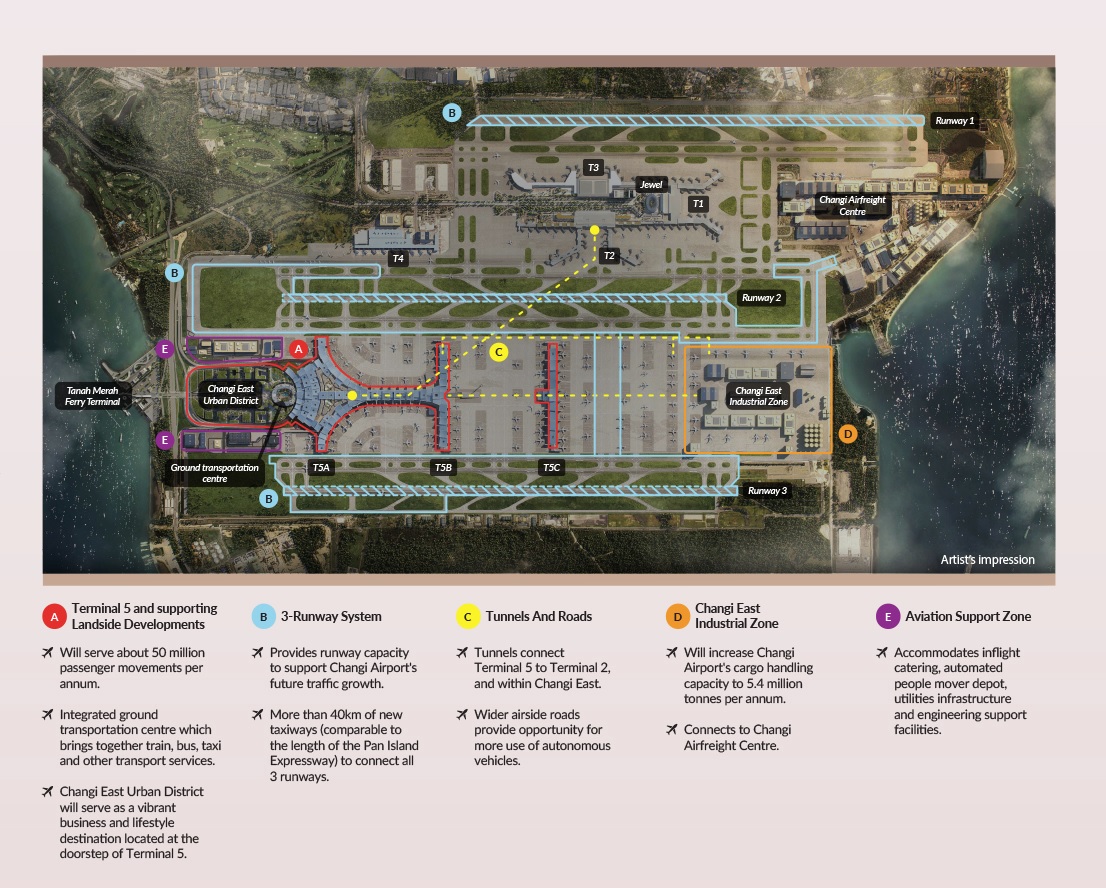

The Changi’s Airport new Terminal 5 (“T5”) will be the world’s largest terminal when completed in the mid-2030s, costing around US$10 bn.

The new T5 will initially handle 50 million passengers annually, boosting Changi’s total capacity from the current 90 million to over 135 million passengers when combined with existing terminals. The new T5’s footprint is approximately five times larger than the existing Terminal, reflecting Singapore’s long-term vision to accommodate growing air traffic demand across Asia and beyond.

The terminal’s layout features three satellite concourses seamlessly connected via automated people movers. This configuration minimizes walking distances while optimizing aircraft parking positions. The new T5 will incorporate cutting-edge automation at every touchpoint, from self-service bag drops to AI-assisted immigration checks, significantly reducing processing times.

Aerial map of the expansion of Changi Terminal 5 (courtesy of Changi Group)

This expansion project presents several technical challenges, primarily due to Changi Airport being built on reclaimed land. This poses potential risks of soil settlement, necessitating additional reinforcement measures to ensure structural stability. The risk of settlement is particularly significant given that the T5 substructure requires excavation to a depth of 28 metres. Furthermore, integrating new infrastructure with the existing terminals and runways will be a complex task, requiring meticulous planning to prevent disruptions to ongoing operations.

Current Progress

Several major contracts have now been awarded including the automated people mover and baggage tunnels and foundation and basement contracts. Three significant superstructure contracts, amongst others, are still to be let.

The construction timeline is as follows:

- 2023–2026: Groundworks and substructure Piling and foundation works for the terminal and third runway. Tunnelling for underground baggage systems and automated people mover (“APM’) links.

- 2026–2028: Superstructure Installation of the steel and glass skeleton of main terminal. Installation of the satellite concourses and APM tracks.

- 2028–2030: Systems integration Installation of baggage handling, AI-driven check-in systems, and energy grids. Testing of automated cargo and logistics networks.

Challenges to the CRL and new T5

Geotechnical Uncertainties

One of the most complex aspects of CRL Phase 1 is the deep tunnelling works. The CRL is designed to pass beneath the Central Catchment Nature Reserve at depths of approximately 70 metres – significantly deeper than the typical 20 to 30 metres for other MRT lines. Tunnelling at such depths presents challenges, including high soil and groundwater pressures, as well as increased risks of rock fractures. Additionally, the tunnels run beneath densely populated urban areas, necessitating exceptional precision in excavation to prevent structural damage to surrounding buildings. This possess a significant risk to the contractor because the procurement trend would be design and build, and the contractor is ‘deemed to have knowledge on the existing ground conditions’.

The piling and excavation works for the new T5 is also likely to encounter unforeseen ground conditions, such as difference in the composition of soil and/or depth of rockhead, which may pose geological risks. The unforeseen ground conditions could result in delays and increased costs, as additional mitigation measures, such as redesigning the foundation works or implementing on-site remedial solutions, may be necessary.

A thorough grasp of contractual provisions governing unforeseen ground conditions is critical to clarify risk allocation and ensure accountability among project stakeholders. Parties must rigorously verify the accuracy of geotechnical baseline reports provided during the tender phase by cross-referencing them with as-built conditions. This involves a meticulous review of site investigation data, historical records, and supplemental surveys to identify discrepancies between anticipated and actual ground conditions. Neglecting this can lead to costly disputes, delays, and unplanned expenses if unforeseen ground conditions issues emerge during construction.

Labour Shortages

Like many developed countries, Singapore’s construction industry faces a deepening labour crisis, driven by an aging workforce and declining birth rates. Over 34% of local construction workers are above 55, signalling a shrinking pool of skilled labour. Meanwhile, the country’s birth rate hit a record low of 1.04 in 2024, well below the replacement level, further straining the workforce pipeline. This shortage has already disrupted major infrastructure projects, including CRL Phase 2 and the Jurong Region Line due to the lack of specialist engineers.

Conclusion

Singapore’s LTPR ensures a pipeline of infrastructure projects for decades to come, with major projects like the CRL and Changi Airport T5 expansion leading the way. That said, the industry is facing increasing labour shortage which is likely to challenge project teams and timelines. On top of this, given Singapore’s complex geology, unforeseen ground conditions will also likely pose persistent challenges to project timelines and budgets. Both Clients and Contractors need to clearly understand how their contracts allocate risks for such unpredictable conditions.

About Contract Dispute Consultants

With offices in Hong Kong and Singapore, CDC are Asia’s leading claims and contractual consultancy providing support to first tier contractors working on complex infrastructure and building projects worldwide. We work to manage and minimise contractual risk to assist contractors in negotiating early resolution of issues before they escalate. Recent assignments have included advising contractors on NEC3 and NEC4 projects involving metro, tunnels and water works. Other assignments have included rail projects in Canada and Hong Kong, cable stayed bridges in the United States, Canada and Hong Kong, power projects in the UK and airport projects.